🚦 3-2-1 Traction — it’s not about the money

Also — the role of product in fundraising; timing; bootstrapping; and how to think about speed versus quality.

Hey friend 👋

This is 3-2-1 Traction — 3 ideas from me, two quotes from others, and 1 question to help you focus.

I’m sending this a day late, so let’s dive right in 👇

Application Deadline: Jan 31st. I’m facilitating the new StartupSac Founder Mastermind. It’s a 3-month intensive program for seed-stage startups led by some of the Sacramento region’s leading experts in startup growth and fundraising. The cohort size will be no more than ten highly dedicated startup founders. Intimate, action-focused, in-person. 💥

3 ideas from me

one: raising money isn’t about product.

Yet most founders fall into two camps:

I have a great idea, so it’s time to raise money so I can build it.

I built a great product from my idea, so now I can raise money.

These are both mistaken.

When you raise your first couple of rounds, expect to iterate. A lot. Whatever product you start with isn’t the product you’ll end with. Whatever customer you start out serving won’t be the customer you end up serving.

Such is the nature of innovation: it’s iterative.

Instead, prove strong demand in a growing market. A quality product should follow.

BUT… if you are rightfully product-focused, check out my upcoming webinar: The Startup Product Playbook. It’s all about how to design products customers just can’t resist.

two: so when should you raise money?

You should raise money when you have figured out:

what the market opportunity is;

who the customer is; and

what the right product is.

The signal?

When you have delivered a product that is being adopted at an increasingly rapid rate.

three: but it’s not about the money!

Most companies don't die because they run out of money.

Most companies aren’t murdered by the competition.

They commit suicide through their own preventable mistakes.

The key to success in a startup is avoiding unforced errors.

2 ideas from others

Mike Salguero, founder of ButcherBox, on bucking the VC trend:

Before ButcherBox, I ran a company called CustomMade, and we had raised about $30 million of capital in five rounds of financing and lost everyone’s money. And in that process, I lost the culture, I lost my place of work, I lost the ability to create the direction of where the company should go. I lost friends. There was some good pieces of raising venture, but I experienced a ton of loss as a result of me raising venture capital. And so when I started ButcherBox, my mentality was, I don’t care how small this business is, I’m not raising a venture. And it turned out the business could be very large, and I believe as a result of not raising venture, we are where we are today.

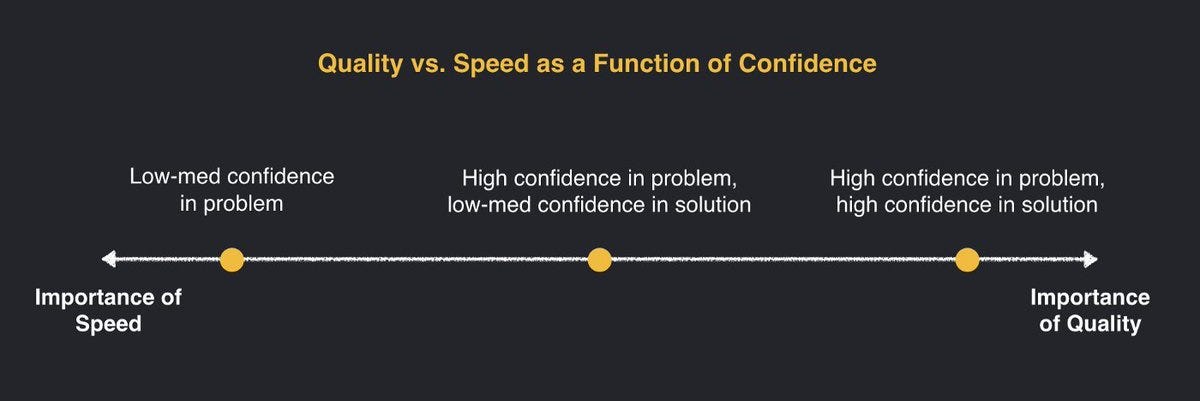

Creator and investor Alex Brogan on speed versus quality:

The more confidence you have in the importance of a problem and your understanding of its solution, the more you should focus on quality.

However, if you need to learn more, move fast and break things.

1 question for you

What’s one question you have for the market that you can answer today with a simple experiment?

See you on Thursday for deep dive on learning from failure.

—jdm