🧠 Deep dive — where I answer your questions

I've got a great set of reader questions: traction metrics, investor theses, buying behaviour, category creation, and more!

Hey friend 👋

I’m back from a few weeks abroad, and while I enjoy little more than spending time with my wife, one of my favorite professional activities is answering your questions!

Seriously.

Fortunately for me, amongst the hundreds of messages that flooded my inbox, were plenty of reader questions. I picked four to answer here.

Maybe I’ll make this “ask me anything” a regular thing.

Read time: 4 minutes.

What are the key metrics for a software startup that would lead a successful traction?

Great question, Zakaria! Let’s talk innovation accounting.

“Metrics” can set us on the wrong track. That word tends to put us in the mind of sales, dollars, revenue, market share, etc. These are “balance sheet” questions, and they’re a good measure of progress for an established business.

But not for a new one, because those metrics are all functionally zero — and often for a long while!

Those kind of metrics are lagging indicators of yesterday’s efforts. You want leading indicators of tomorrow’s success.

For an early-stage SaaS startup, this will flow through the chain of buying behaviour:

Can you find the people you think would be customers?

Do they have the problem you think they do?

Do they want a solution badly enough to pay for it?

Do they want your solution?

Do they want it delivered in this way?

Will they pay for it in this way and for this amount?

etc.

Eventually, this blends into the pirate metrics: acquisition, activation, revenue, retention, and referral.

Focus on the earliest possible indicator for which you don’t have conclusive data. That’s where you fin traction.

For deets, check out my prior newsletters on innovation accounting, early-stage measurement, and the flow razor.

Click here to add your two cents.

Why isn’t my messaging to funders working?

I’m honestly not sure.

The first question that comes to mind is why it doesn’t work to parrot their theses back at them? If they say they fund seed-stage ventures in a geographic region across particular verticals, for example, why isn’t it enough for you say that applies to you?

And that leads me to a broader question: are you sure the thesis is where you’re missing the mark? If not, ask some followup questions. If it’s the thesis, which part?

It’s an important question, and I’m glad you’re exploring it because a thesis mismatch is the best way to waste an investor’s time — and yours.

But it could be that you’re just not fundable yet.

Let’s crowdsource!

Reply to this email if you’ve got some ideas to help Nic and I’ll do a followup.

Or click here to add your two cents

What do you do when potential customers say you’re great, but don’t buy?

Yes! This is so common, Farmon.

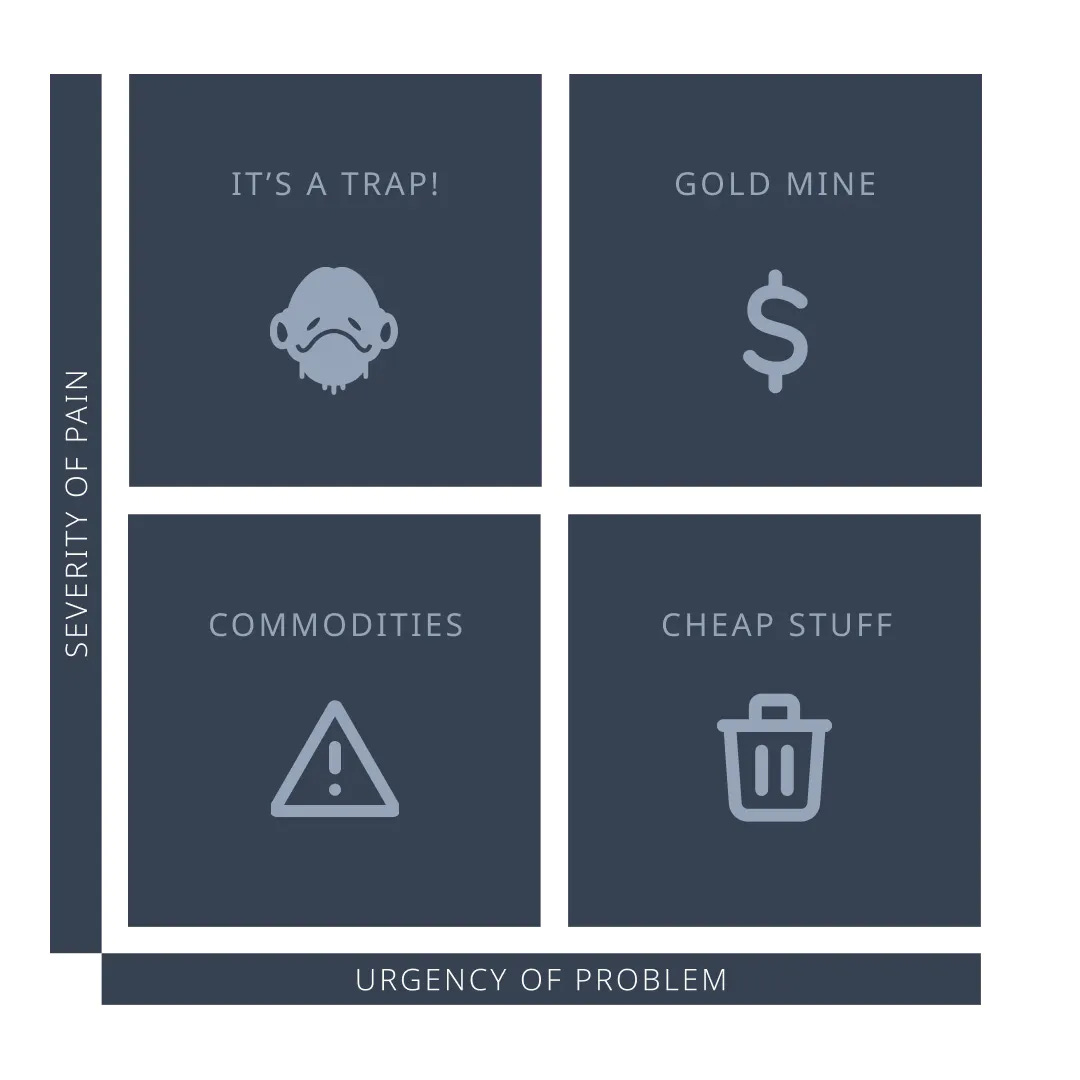

By far, the biggest reason is that you have pain, but insufficient severity or urgency.

I dedicated a whole newsletter to this problem last year, and here’s the gist: it doesn’t matter how big a problem it is if they feel no urgency to solve it.

Go back out and talk to some customers, and ask about all the other problems on their plate right now. See if you can get them to rank those problems by severity.

Where does yours sit on that list?

If it’s number one or two, come back and let’s chat. If it’s the third most important (or worse!) you might have the wrong audience. Look for this one:

Who is experiencing this problem so acutely that it’s the most important thing for them to solve right now?

Click here to add your two cents

What process would you use to define your startup with category creation?

Plot twist! Wasn’t expecting this one, June…

Let’s get to it.

I think I want to start by challenging some assumptions within the question. When we think about category creation, we could mean it in two different senses:

Selling a new kind of thing in a brand new, “blue ocean” market.

Creating a brand that seems like the above to the customer.

The former is a finding a new cut of steak. The second is renaming an existing cut of steak to emphasize the sizzle.

Most companies that are “defining categories” fit into the second option. It’s a branding and marketing question that’s not very interesting to me — because I’m not a marketer. 🙃

True category creation is what’s interesting to me as a design-thinking-loving startup guy, because it’s the work that leads to completely new industries, sometimes seemingly overnight.

But back to the assumption I wanted to challenge.

If you’re working on a defined product, and it’s not a new market, then you didn’t create a new category. Trying to twist your startup into a new category is probably more a brand marketing question than a market definition question.

To be clear: that’s not wrong!

99% of startups don’t create new categories, and new categories are the riskiest kinds of startups to pursue. You don’t just have to create a new product (which is hard enough) but you also have to create a new product and create new demand within it.

So why do you want to define a new category, June?

Click here to add your two cents

Got your own question?

I’m fielding your questions! Reply to this email or hit me up on social, and I might address it here, or record a video response.

Whenever you're ready, there are 3 ways I can help you.

If you’re still in the idea-to-seed stage, trying to get early traction, I’d recommend starting with some coaching:

→ Book a 1:1 coaching session to tackle one key challenge, from prototype to pitch.

→ Apply to my Traction Coaching program, and we’ll find traction together.

If you already have early traction, I’d recommend running a Traction Sprint to find the traction you need to get from Seed to Series A.

Of course, you can always ask me a question for my weekly office hours livestream.