🧠 Deep dive — the 3 rules of startups

Startups are really hard, but they’re not complicated: first know what the thing is; know what you know vs what you’ve assumed; test the riskiest assumptions; rinse and repeat.

Hey friends 👋

There are about a thousand tools and procedures and best practices for startup founders:

This canvas and that canvas... lean this and lean that canvas... this hacking and that hacking...

Obviously, entrepreneurship is crazy complicated, requiring galaxy brain to make sense of it:

Except... it’s not. Entrepreneurship is really hard, but it’s not complicated.

In fact, there are only 3 rules.

Let’s dive deep 👇

Seriously — not complicated.

The work of the startup founder is just following three key rules, which form an iterating loop:

Maintain a model

Separate fact from conjecture

Test the riskiest conjecture

Hard, but not complicated:

You first have to know what the thing is. Then you have to know what of that thing is known, versus what you’ve just assumed. Then, you have to test the assumptions that are key to the success of your business but which are the least known.

And then... rinse and repeat.

There’s a lot to unpack here, so let’s get started:

Rule #1: Maintain a mental model

Being a startup founder is like being an explorer in the wilderness. There’s a far-off mountain you’re trying to get to — there’s gold in them thar hills! — but you can’t just leap there.

It’s not a leisurely nature walk; it’s an expedition. It’s dangerous, and it takes days or weeks or months.

Often, you can’t even see the mountain through the dense forest foliage.

So you have to look for signals that you’re on the right track:

Is the river bank still to our right?

Are the stars oriented to our destination?

When we can see it, is the mountain getting larger?

etc.

Similarly, your job as an entrepreneur is to find the signals that you should be seeing if you’re getting closer to your mountain — to your goal of a scalable business. But’s impossible to interpret those signals without the context of a model, which in this case is a cartographic map of what’s in the known world vs what’s not yet known.

But in the case of a startup, what do I mean by “model”, exactly?

A model tells you what is, and what you think is.

When I talk about models with startup founders, they usually think spreadsheets with financial projections, and hockey stick graphs, and balance sheets, and so forth.

And it might be that… eventually.

But at first, it’s just a mental model. It’s just what we think the startup “is”.

Later, your model might be driven by pirate metrics, with an eye toward the earliest metric for which we find risky conjecture.

And, sure — it’s eventually a robust financial model that we’re testing in the marketplace.

But regardless of your stage, it’s something that we can use to tell us what the thing “is” that we’re talking about, and what it means to be on the right track.

After all, one of the biggest experimental mistakes founders can make is to take an action in order to “see what happens”. Instead, you have to take an action in order to prove what you think will happen because your model is correct.

Thus: always know your True North, stress test it constantly, and incessantly revise it — in other words, build, measure, learn.

So what kind of model should you develop?

The simplest model is usually most impactful.

It’s easy to overcomplicate a startup, particularly when we start dropping terms like “model”. In fact, it takes persistence and grit to keep it as simple as it needs to be to remain both useful and agile.

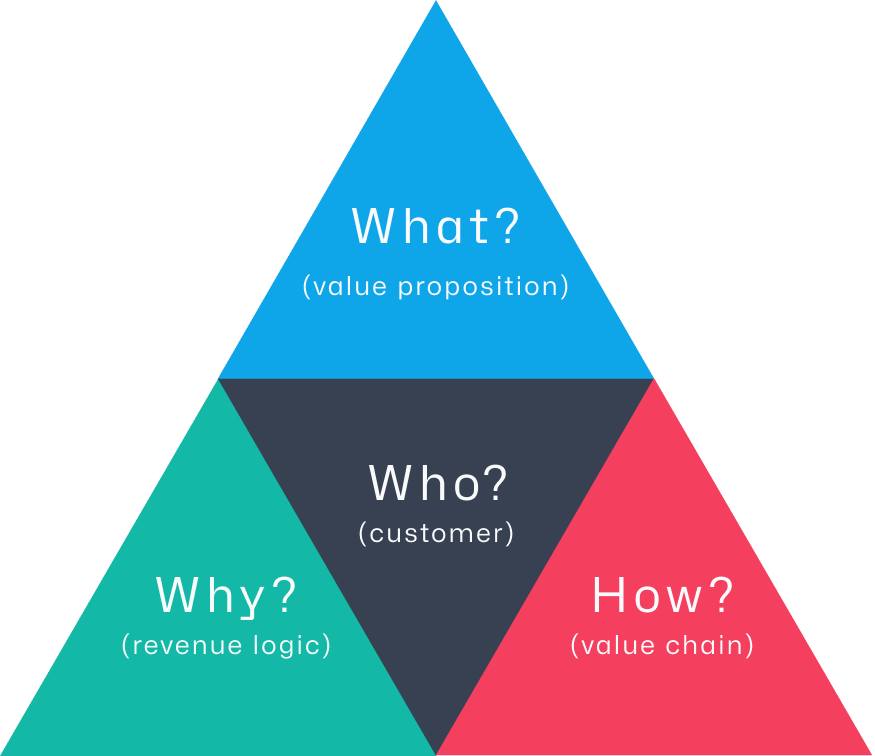

The model I use is called the “Startup Core”, and it couldn’t be simpler.

It’s based on an academic definition of a business model called the Magic Triangle, which I’ve turned into a model that you can use starting on Day 1, but still works on Day 1,000.

In other words, it can be a mental model at the outset, and it can power a robust financial model when you're ready.

The Startup Core answers four key questions about your business:

Who is the customer? Do they exist? Do they have the problem you think they do? Are there enough of them out there to make this worthwhile?

What is the value you’re creating for the them? Do they want a solution to this problem? Do they want yours? Do they need it with sufficient severity and urgency to drive a purchase?

How is that value created and delivered? Do customers want it in the way you’re offering it? Are you able to get the offer in front of them cheaply and efficiently?

Why will this make money? Will they pay what we need to turn this into a viable business? Is this a large enough, sufficiently growing market to make this worth your time? Is now the right time to chase the opportunity?

Or, if you prefer cheap infographics:

There’s a lot packed into those 4 questions, but want to know what the cool part is?

All the models I mentioned above (mental, pirate, and financial) are all based on the same core.

Over time, we go in greater depth and add greater specificity, but they all start with the same four questions. In fact, the Business Model Canvas is just a 9-box representation of these four questions.

As it is with your business, the Startup Core starts out simple, but grows with you over time. As your assumptions become validated learning, you add more detail and measure with greater specificity, which automatically becomes more robust model. 💥

And that brings us to a critical point:

The first rule is to maintain a model.

Not to have a model, but to maintain one.

This is implies a level of dynamism:

Use the Startup core to document your model

Identify the riskiest assumptions within that model

Run experiments to turn assumptions into validated learning

Rinse and repeat.

Because, after all, that's all a startup is.

But it all starts with having a Startup Core that’s solid. A flabby, flimsy model unsurprisingly produces flabby, flimsy results.

And that brings us to the second rule:

Rule #2: Separate fact from conjecture within that model

Steve Blank once said a startup is just “an organisation in search of a business model”.

When you’re doing a startup — or anything innovative — you’re operating in a world of unknowns. Once you get rid of all the unknowns, you’re operating in a world of knowns, and therefore no longer doing anything innovative.

And that’s the point — in the most literal sense, the work of the startup is to make known that which is unknown.

But the only way to get started doing that is to separate what you know from what you think you know, so that you can validate the stuff you don’t.

Critically:

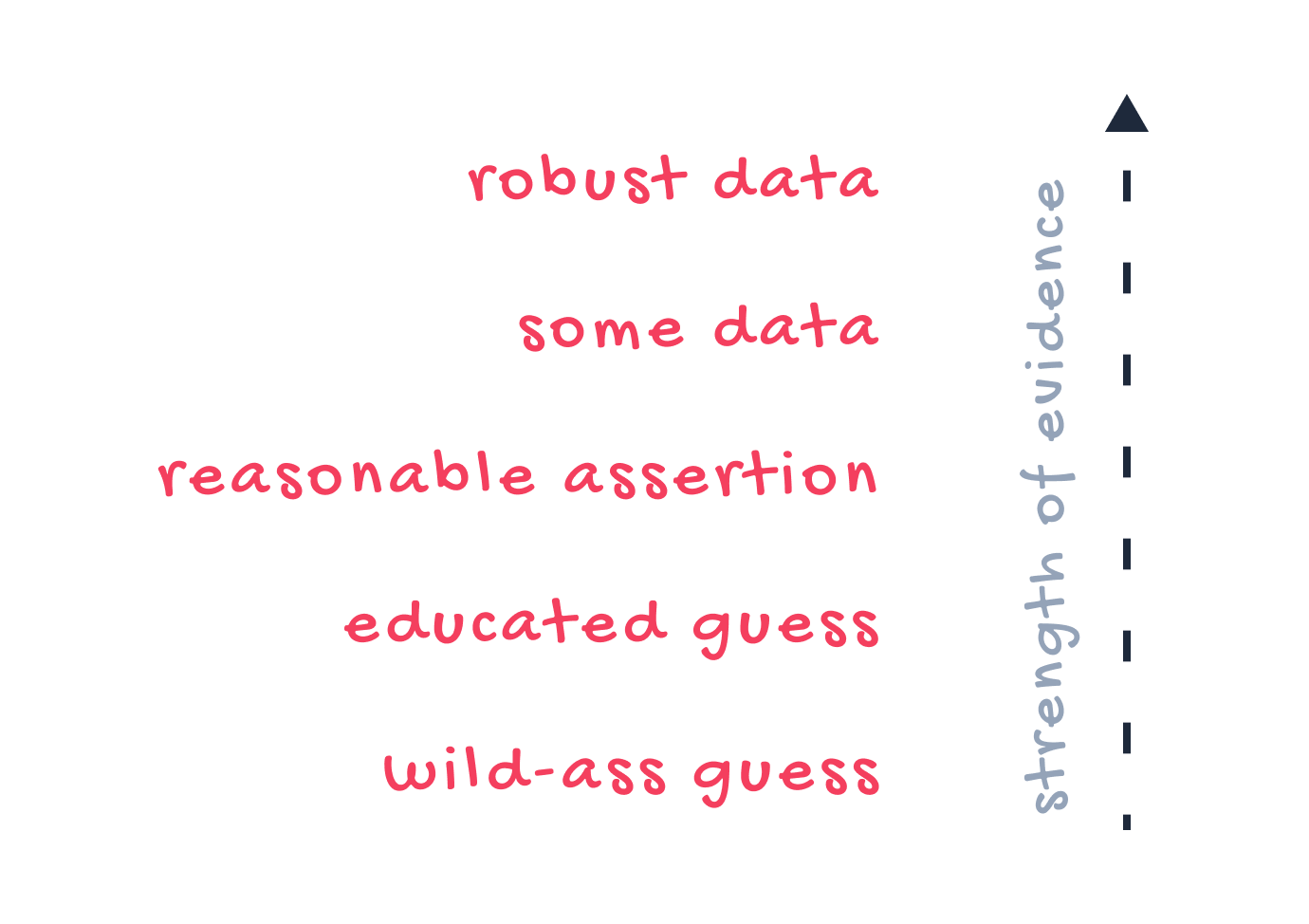

“Fact or conjecture” is a false choice.

Because evidence exists along a spectrum of increasing certainty, from wild-ass guess to robust data:

Usually, our ideas start lower down, and that’s okay.

In fact, it’s fantastic, because it gives us a to-do list of what we need to validate in order to move forward, and it tells us how we should size our bets:

Always proportion your effort to the evidence.

This is one of the biggest mistakes founders make — they invest too soon, go big too soon, scale too soon, etc.

But the data tells us how much effort we should expend:

Little evidence you're on the right track? Only expend a little effort.

Tons of evidence? Maybe you can afford more effort.

Only expend as much effort as you have evidence. Never bet the farm on a wild-ass guess, but triple-down hard when the evidence is robust.

And because we’re talking startups, the effort we’re talking about is an experiment, and that leads us to the third rule:

Rule #3: Test your conjectures

As Steve Blank is fond of saying, there are no facts inside the building, so get out of the building!

Neither you, nor your team, nor the industry “experts” have answers — startups spend most of their time formulating questions.

That means you need to run experiments to find out if you’re on the right track.

Remember: we’re not just creating a model; we’re maintaining a model.

One of the most-talked-about founder mistakes is waiting too long to expose what you’re working on to the world.

Stealth mode doesn’t work!

That’s why one of the most important founder performance metrics is time-to-customer (TTC) — the length of time it takes to go from idea to testing it with real customers.

TTC necessarily gets longer the more mature a startup is, but from day 1, it’s measured in just hours. Maybe even minutes!

So take those smart questions and go talk to customers — as soon as possible.

But how do you know which questions to ask?

It’s all about mitigating risk.

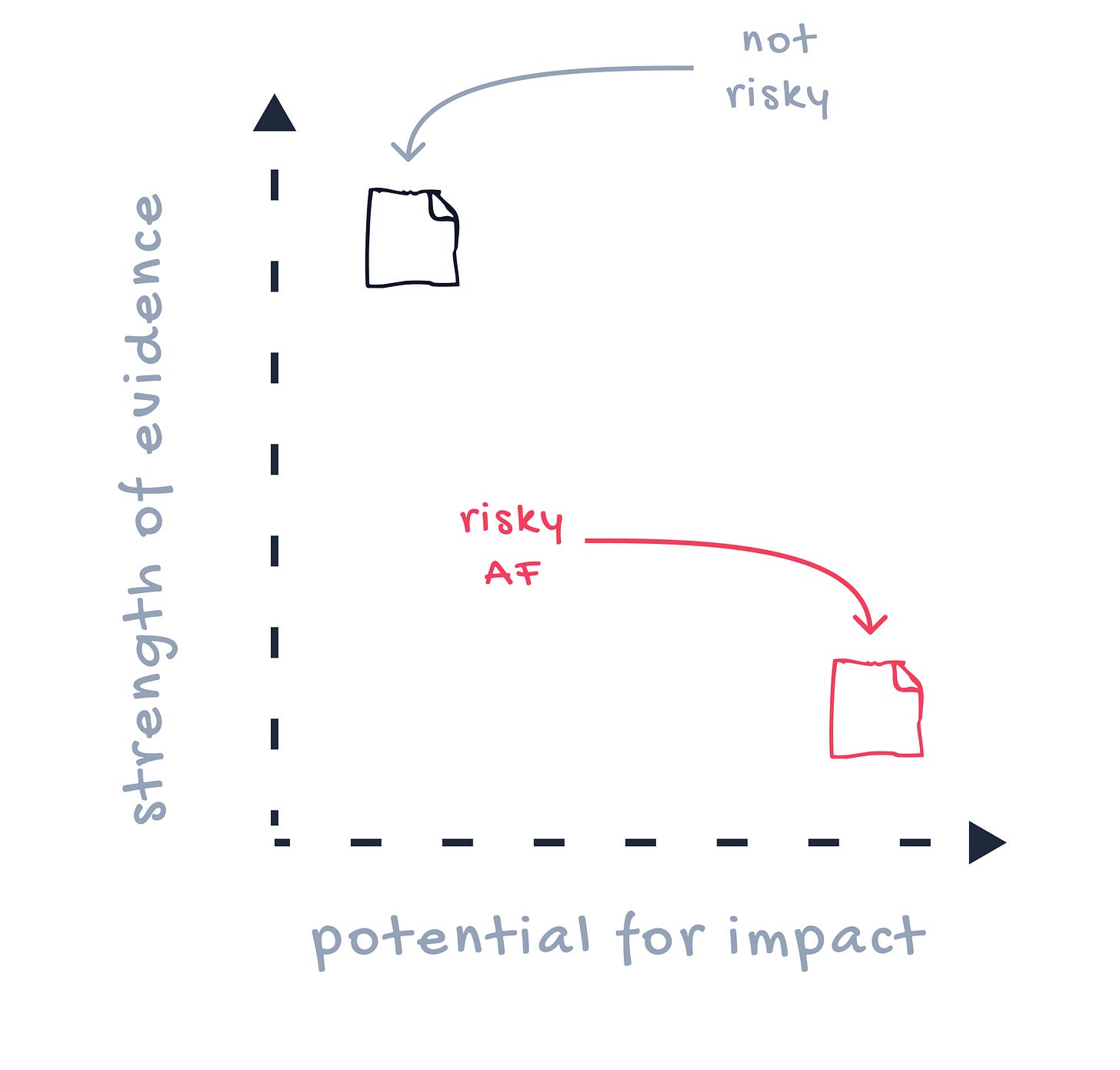

Those conjectures of yours have a strength of evidence, but they also have a potential for immediate impact:

Some things don’t matter any time soon if you’re right or wrong — like the colour of your logo.

Other things will kill you if you’re wrong — like whether customers have the problem you’re solving.

By definition, risk is the intersection of the evidence and the impact of your conjectures:

So a wild-ass guess with no impact? Who cares!

Ditto for a conjecture with robust evidence and high impact.

But a wild-ass guess that kills you when you’re wrong. Yikes!

As a rule: test your riskiest conjectures first, because if you don’t survive them, nothing else will matter.

By test, we mean experiment.

It’s got many AKAs:

Bet

Test

MVP

Next step

Experiment

Whatever you call it, your goal is to put in as little time & money as possible to find out if you’re on the right track — because we proportion our effort to the evidence.

If you remember science class, an experiment is a controlled test of one specific hypothesis, for which we know both what to measure and what an unsuccessful measurement looks like.

An experiment looks like this:

I believe that [hypothesis].

To verify that, I will [do something].

And measure [this particular number].

I am right if [the measure is X].

Here’s an example:

I believe that my product statement will resonate with customers on LinkedIn.

To verify that, I will send InMail messages to 20 potential customers to ask for a phone call.

And measure the number of affirmative responses (conversions).

I am right if 10% get on a call with me.

Finally, once you have the data:

Revise the model.

None of this matters if you don’t learn anything from it.

None of this matters if your new data doesn’t cause a change in your behaviour.

So any any experiment necessitates revising the model from Rule #1, and running through the cycle again...and again, and again, and again... until you’re no longer a startup.

Now, this process might sound familiar...

These three rules form the core of the build-measure-learn loop.

But it’s also a process with many AKAs:

ideate, experiment, data;

analysise, synthesise, test;

hypothesise, prototype, test, learn;

empathise, define, ideate, prototype, test;

observe, think, hypothesise, experiment, reflect;

etc.

But don’t overcomplicate it. It’s simple:

Maintain a model

Separate fact from conjecture

Test the riskiest conjecture

Rinse and repeat.

And, honestly? That’s all entrepreneurship is.

What’s your current model? Drop a comment and let me know.

See you next week,

—jdm

PS: If you enjoyed this issue of Traction Thinking, I’d be super grateful if you took a few seconds to share it with a founder friend. Referrals are a huge help in growing a newsletter — and really help getting more founders to think deeply about their path to traction.

And, as always, I’d love to hear your thoughts. If you have ideas how to make this newsletter even better, have suggestions on future topics, or even just want to share what you thought of this issue, just hit reply or leave a comment.